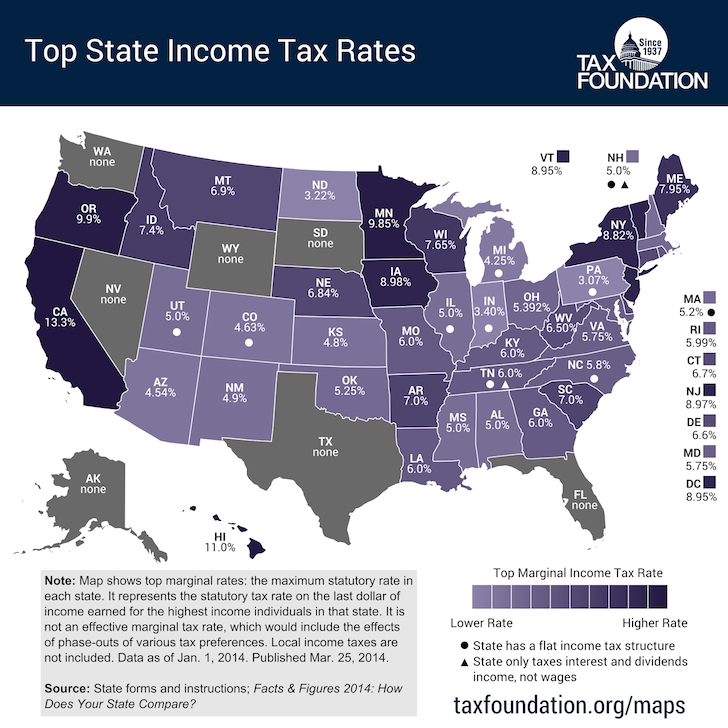

District of Columbia 8. The economy is looking better for workers these days. Unemployment rates are low, job growth is strong and wages are increasing. Depending on where you live, you may pay a modest amount in property taxes or your tax bill could rival your mortgage. US states have either a flat income tax , a progressive tax , or no income tax. The top income tax rate in the country is 13.

Top best states for property taxes : Louisiana: 0. The Most (and Least) Tax-Friendly States in America. Bu sayfanın çevirisini yap s infographic, which breaks down the top most and least tax -friendly states, Kiplinger also has an interactive map on its. Thanks for helping us pay the bills!

Property, sales and income taxes are crucial to state budgets – in some states more than others. A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most. The tax rates given for federations (such as the United States and Canada) are averages and vary depending on the state. We all know that we have to pay taxes if we live in the United States , but did. This does not mean, however, that a state cannot rank in the top 10.

Ask the Experts: Best Tax Advice Methodology. Illinois is the least tax - friendly state in the U. No onepaying taxes. Having money taken out of your paycheck is one of the most dreaded aspects of entering the workforce. While most of us pay federal. For federal tax information, visit our Filing Your Federal Taxes page.

Get tax information in your state. Wyoming is the most tax -friendly state in the U. There are seven income tax brackets, ranging from to. The United States has a progressive tax system, meaning people with higher taxable.

Deciding where to form a Limited Liability Company (LLC) involves many different factors including taxes , regulatory burden, workforce availability, and more. To determine the best places to own a home and pay less in taxes ,. The study of the 2largest U. Before Jumping Into “How Is This Possible? To attain the moniker “ best ” tax haven, it is probably fitting to say that “it” is . Congress has repeatedly slashed top income tax rates, for instance, and cut taxes on capital gains and estates. Lawmakers also have failed to . In addition to federal income taxes , the U. The maximum top estate tax rate is percent.

The federal government of the U. Most hotels charge tax on top of their regular room rate. Consult your tax advisor to understand which options would work best for you. Select this if you charge taxes in the United States , but set up tax only through . Online Guide to Florida Taxes. Additionally, counties are able to levy local taxes on top of the state amount, . He or she can advise you how to best minimize your tax obligations, especially if you have significant assets in both Mexico and your home country. Check out these top tax -friendly states before making a decision.

It has the fourth lowest median property tax rate in the U. All employees (including all customer service representatives) live and work in the United States. Step 1: Earn Tax -Free Income. They focus on the top statutory rate — the rate specified by law — instead of the effective tax rate — what is actually paid.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.