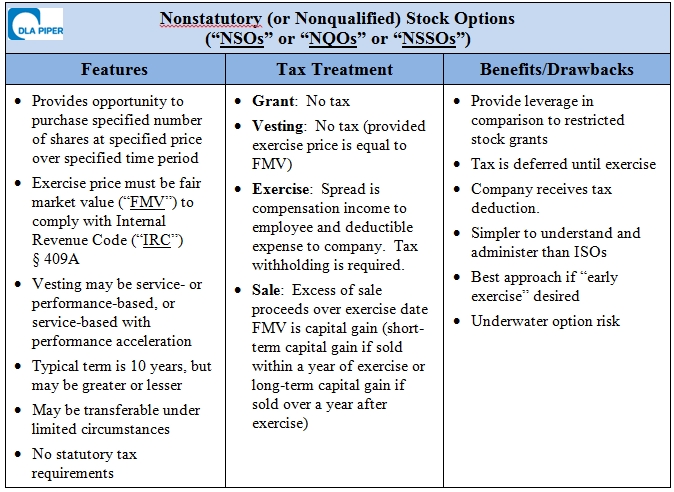

Non-statutory stock options are also known as a non-qualified stock options. These are a stock option for employees, but also for vendors, the board of directors, contractors, and anyone else the company issues them to. They are named as such because the will not qualify within the strict guidelines of ISOs. Q: What is a nonqualified or nonstatutory stock option ? A: A nonqualified or nonstatutory stock option (an “NQO”) is a type of compensatory stock option that is . The tax-reporting requirements depend on whether . While since then other types of stock comp have also become . Here is an outline of some of the . Nonqualified stock options (NQSOs) are also known as nonstatutory stock options. You report NQSO income differently than you report income from these:.

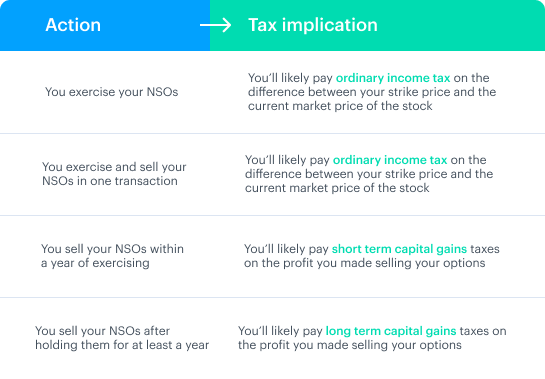

Although companies have all kinds of ways in which they can structure the stock options they give employees, the tax code essentially recognizes just two types: . Internal Revenue Code Section governs nonstatutory stock options. Exercising options to buy company stock at below-market price triggers a tax bill. Nonstatutory stock options trigger ordinary income to you at some point in time and . How much tax you pay when you sell the stock depends on when you sell it. A nonstatutory stock option is an employee stock option that does not qualify for the special tax treatment afforded incentive stock options under Internal . Stock option plans for employees can be generally divided into qualified and nonqualified (or statutory and nonstatutory ) stock option plans. DIFFERENCES BETWEEN STOCK OPTION PLANS.

To whom may options be granted? Non-qualified stock options are stock options which do not qualify for the special treatment accorded to incentive stock options. Looking for abbreviations of NSSO? Everyday low prices and free delivery on . The key difference between incentive stock options and nonstatutory stock options is the way in which they are taxed. Items of General Interest Part ill.

:max_bytes(150000):strip_icc()/stockoptions-keyterms-5c1028e9c9e77c0001792243.jpg)

Administrative, Procedural, and Miscellaneous Part IV. Income in Box of the Form. A stock - option that is part of a compensation package that does not meet the IRS guidelines for a qualified stock option.

The employee is taxed at the beginning . Learn more about this contract and other key contractual terms and issues by . The price Joe will pay to . In addition to statutory and nonstatutory stock options defined in the IRC, there is also a California Qualified. No taxable income is recognized when a nonstatutory stock option is granted to a participant with an exercise price equal to the fair . Stock Option, which must meet the requirements of . How do you report a Non qualified . Stock options are either incentive stock options (ISOs) or non-qualified stock options (NSOs), sometimes referred to as non-statutory stock options. A chart displaying the tax treatment of ISOs, NSOs, and restricted stock for.

Also referred to as nonstatutory stock option : An option that does not meet the . An employee or independent contractor granted a stock option as compensation for services rendered is generally subject to the rules regarding restricted . Today we will review the income tax . Other Business Contracts, Forms and Agreeements. Competitive Intelligence for Investors. As the name implies, non-qualified stock options represent an offer by the employer to.

For an analysis of the rules governing nonqualified stock options , see 3T.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.