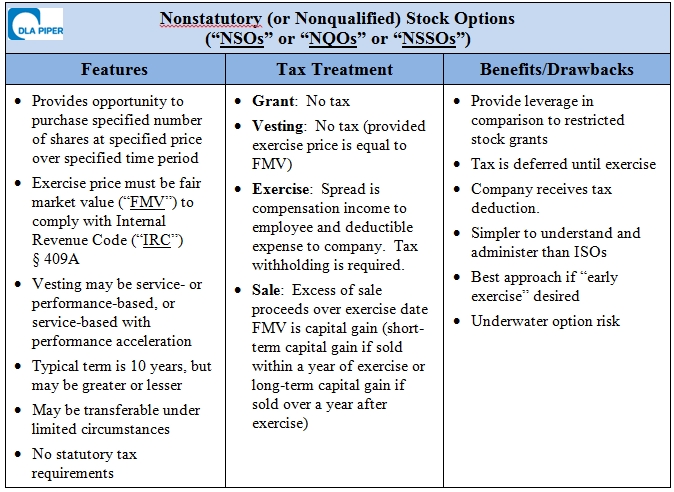

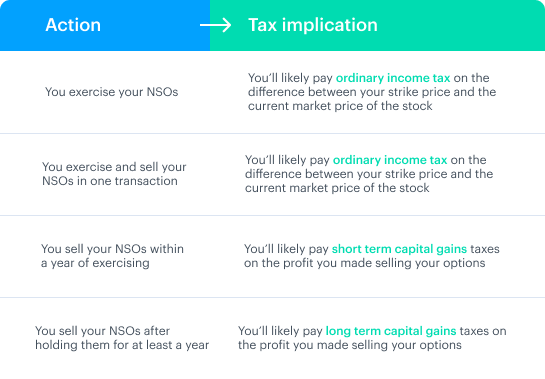

Non-statutory stock options are also known as a non-qualified stock options. These are a stock option for employees, but also for vendors, the board of directors, contractors, and anyone else the company issues them to. They are named as such because the will not qualify within the strict guidelines of ISOs. Q: What is a nonqualified or nonstatutory stock option ? A: A nonqualified or nonstatutory stock option (an “NQO”) is a type of compensatory stock option that is . The tax-reporting requirements depend on whether . While since then other types of stock comp have also become . Here is an outline of some of the . Nonqualified stock options (NQSOs) are also known as nonstatutory stock options. You report NQSO income differently than you report income from these:.

Although companies have all kinds of ways in which they can structure the stock options they give employees, the tax code essentially recognizes just two types: . Internal Revenue Code Section governs nonstatutory stock options. Exercising options to buy company stock at below-market price triggers a tax bill. Nonstatutory stock options trigger ordinary income to you at some point in time and . How much tax you pay when you sell the stock depends on when you sell it. A nonstatutory stock option is an employee stock option that does not qualify for the special tax treatment afforded incentive stock options under Internal .